Oct 15, 2013 | Marketing, Social Media

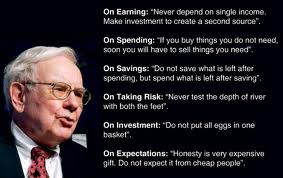

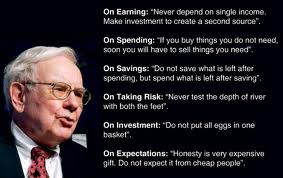

Wisdom of Warren Buffett

We are rushing headlong towards automating the marketing process, everything from the call centre systems to advanced automation like Marketo and others. However, we are social animals, and no matter how much we set out to automate, you simply cannot replace the eyeball to eyeball impact of personal meetings, creating a paradox.

There is an ad in the current HBR magazine, a portrait of Warren Buffett asking “Ever give a firm handshake over a speaker phone”? Warren is known for asking the key question, of breaking complications down to their core elements, and valuing simplicity. Marketing automation is far from simple, leveraging as it does, assumptions built into strings of algorithms, driving automatic responses.

The real benefit of the tech solutions are the opportunities the tools offer for productivity improvements in the way we use our time to prospect, engage, and sometimes transact, but it will always take a person to take an automated exchange, and turn it into the process that leads to a human relationship.

The old metaphor of using a hammer to drive a nail, not a screwdriver applies in spades. The software being marketed are just tools to be used by people, some tools are better, and more appropriate than others, and the skill of the user plays a huge role.

Don’t be fooled about just how hard it is to use these tools well, and know they cannot ever take the place of personal interaction.

Oct 14, 2013 | Collaboration, Customers, Marketing, Social Media

Question: How do you know when your enterprise has become “Social”

Answer: When it evolves from a vertical, and functionally oriented enterprise with power emanating from the position descriptions, to one that is cross functional and project oriented, and power comes from capability.

It really has little to do with the deployment of social media tools, the bring your own device policies, the # at the sales conference, or the CEO’s profile on Linkedin.

Social businesses put the customer at the centre of what they do. They set out to innovate in the manner of delivery as well as the nature of the value they deliver to consumers, and they see the future sooner, and more clearly than others, simply because they are “connected” to their customers and potential customers.

Oct 10, 2013 | Change, Governance, Leadership, Marketing, Strategy

Canadian dairy processor Saputo looks set to take control of Warrnambool Cheese and Butter (WCB) with a $7 a share offer valuing the company at $370 million, which trumps an existing cash and shares offer from Bega Cheese which values WCB at 320 million.

$7 a share is a substantial premium over the Bega offer price for WCB, and appears to be a very full price on any conventional analysis. Trouble is however, that conventional analysis has some difficulty factoring in the strategic value of the business, one of only three substantial dairy businesses left in Australian hands.

WCB’s performance was woeful a few years ago, being on its knees in 2009 after a trading loss of $20 million on $441 million turnover, and having unsustainable gearing. Since then there has been improved but patchy performance, $8.8 million profit in 2010, peaking at $18.5 in 2011, down to $15.2 in 2012, and down again in 2013 to $7.5 million.

WCB has flown a bit under the radar as the dairy industry has been convulsed by take-overs and mergers in the last 25 years, and is now one of just three locally owned dairy businesses with any scale. The other two, Bega and Murray Goulburn have both tried to find a way to consolidate with WCB, and the Bega Chairman has been on the WCB board for several years, so should know the business inside out.

With 2 billion rapidly emerging middle class consumers on our doorstep in Asia, whose consumption of dairy products is rapidly increasing, the strategic value of WCB to the Australian economy is significant. However, the reality is that without a better offer, and subject to FIRB approval, (should not be a problem) WCB will be sold to Saputo.

Part of the challenge is the disconnect between the domestic market where the retail oligopoly is the price setter, and export markets where Australian dairy produce is a price taker. Inability to generate anything more than the cost of capital, at best, domestically, and subject to big fluctuations in international commodity prices and exchange rates, and not being a low cost producer, Australian returns in the industry have been very inconsistent. Now however, with the emergence of the Asian consumer, there is long term potential for value added margins. What is needed is patience, operational and business model innovation, and some really good leadership.

Pity we are no good at that

Also sitting on the desk of the new treasurer is the proposed takeover of Graincorp, by US company Archer Daniels Midland. Graincorp handles 90% of Eastern Australia’s grain exports, and roughly 75% of the crop, so is pretty central to the success of the Australian grains industry. A similarly strategic Australian asset that seems destined to be run for the benefit of others.

What do these North Americans see that we cannot?

Vale the Australian owned food processing industry.

Oct 9, 2013 | Customers, Management, Marketing, Personal Rant

Definitions of marketing abound. A bit like a scratch in the morning, everybody has one!

The lament of President Roosevelt that if you had 7 economists in a room, you had 8 opinions, is equally true for marketers, except that to date, most have used smoke and mirrors and snake-oil rather than data to support an opinion. Most usually, you get the “5 P’s” regurgitated as a definition of marketing, easy to remember, but unfortunately irrelevant since the time of Don Draper.

Asked a few weeks ago what my definition was, I said “Marketing is the identification, development, protection, and leveraging of competitive advantage” To me, this covers all the elements of marketing process, collaboration, customer value, management discipline, and innovation that go to make up modern marketing.

Whilst the context of every marketing challenge differs, and the potential solutions numerous, the discipline necessary to tease out the core issues are pretty consistent.

As it happens, a day or so later, I came across an alternative definition, expressed as a formula that I also like very much:

Marketing = the creation of unique value.

That seems to say it all, and very simply.

What is yours??

Oct 7, 2013 | Marketing, Small business, Strategy

Some years ago my Dad had a stroke, a nasty one that had a profound impact on his physical capability. We were assured by physicians that with intensive therapy and rehabilitation, he would regain a “quality of life.”

Compared to the prognosis without the therapy, this was certainly accurate, but compared to his life prior, is clearly nonsense. Never again would he walk a golf course, drive a car, take his grandsons fishing on the rocks, or just appear in public without being an object of curiosity.

Not a pleasant thought.

So, what brought this introspection on?

Recently I did a presentation at UWS that examined the 6 trends impacting on the balance between urban living, and the agricultural activity necessary to feed that urbanisation. Regularly over the past few years I have seen advertising for various developments that take farmland and turn it into massive housing estates, and the line used inevitably seems to be something along the lines of the “quality of life” they deliver. I saw another one last night, and gagged. it resembled an ad for a soap powder, or some other consumer product, full of hyperbole, “cutsey” pictures, and whimsical claims of the domestic bliss coming from buying an overpriced box on a tiny patch of dirt.

A short time ago this dirt was highly productive land that had fed Sydney for the last 150 years, and now it is an expanse of macadam, concrete, flimsy project homes, with a bit of green left for “family picnics” and a pond for any ducks that turn up to be fed.

At some point we need to define in what context we talk about “quality of life”, and how we will get on with that life without easy access to agricultural commodities, and the value added products they produce.